Conventional wisdom suggests that an American recession is imminent, either during the second half of this year or the first half of the following year. But how much should we attribute it? While there are economic headwinds, we should also remember that the pace of inflation is easing, unemployment remains low, and the second quarter earnings season showed a high rate of surprises to the upside.

If it’s not quite a rosy picture, it’s far from doom and gloom. In the eyes of Goldman Sachs equity analyst David Kosten, this is an indication that the US may be poised for a bounce.

Elaborating on his case, Kostin writes, “Flexible US economic growth, which is the primary variable in our sales model, should support S&P 500 revenue growth in 2023. Economists at Goldman Sachs project real US GDP growth of 2.1% in 2023 compared to the consensus estimate.1.6% of growth, which partly explains our forecast for sales growth that beat consensus.Our economists set a mere 20% chance of the US economy entering a recession within the next 12 months, compared to an average probability of 54% “.

Building on this positive sense of growth potential, Goldman Sachs analysts have recently upgraded the ratings of several stocks. Below are the details on two of their picks, taken from TipRanks platformalong with analyst comments.

Teledyne Technologies (TDY)

The first company we’ll look at is Teledyne, an engineering company involved in the creation and production of enabling technologies for industrial growth markets. The company produces a broad range of products, including digital imaging sensors, wide-field camera systems, surveillance and control devices, aircraft information management systems, electronic communications systems, and satellites.

The company operates in four divisions – Instrumentation, Digital Imaging, Engineering Systems, and Avionics & Defense – and its product lines have found their way into numerous applications. Teledyne is based in California, but it also has operations in Canada, the United Kingdom, and Western Europe and boasts a market capitalization of approximately $19 billion.

The company’s strong position as a leader in high-tech devices has resulted in a solid revenue stream — over the past two years, Teledyne has consistently brought in quarterly revenue of $1.3 billion. The company’s latest report, for Q2 ’23, showed a top line of $1.42 billion, 5.1% better than the year-ago quarter and $11.43 million higher than its pre-release estimate. The company’s earnings number, reported as non-GAAP diluted EPS of $4.67, was 2 cents higher than forecast and compared favorably to $4.43 in the prior year. Teledyne reiterated its non-GAAP full-year earnings forecast, forecasting earnings per share of $19 to $19.20 for 2023.

However, the past six months haven’t been a great deal for the stock, which has seen a drop of 8%. Goldman analyst Noah Poponac puts the pullback down to “concerns about the level of profit margin over the long term” in the company’s digital imaging segment. Still, noting the company’s overall quality and strong fundamentals, along with its relatively low share price, Bobonac sees a lot to like here.

“TDY is one of the highest quality, most consistent, and best managed companies we’ve covered over time,” Poponac explained. “The stock has recently regressed to relative valuation lows, just as the balance sheet is close to full strength again for further deployment following the FLIR integration, while the underlying organic organic picture remains strong. We see the upside to consensus earnings expectations and find the current valuation attractive.”

Accordingly, Bobonac boosted its valuation from neutral to buy and set a price target of $495, indicating a potential upside of 23% for the coming year. (To watch Bobonack’s record, click here)

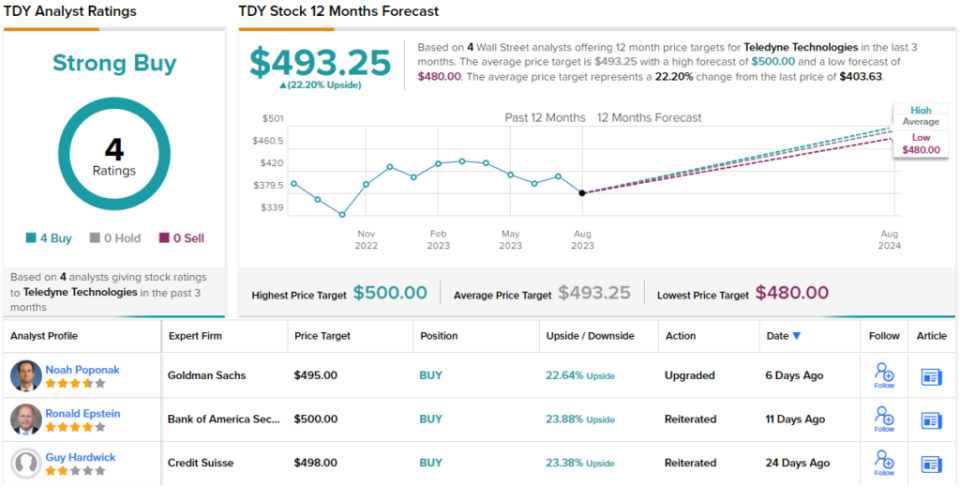

There is general agreement on Wall Street that Teledyne is a quality stock, as evidenced by the consensus of 4 recent analyst reviews – resulting in a Strong Buy consensus rating. The stock’s trading price of $403.63 and average price target of $493.25 combine to point to room for a 22% increase in the shares in the next 12 months. (be seen Teledyne stock forecast)

Okta, Inc. (OKTA)

Next up is Okta, a cloud-based software company focused on user authentication and identity control. Okta offers a product line based on Identity Cloud, and the company’s platform can be used to verify the identity of the customer and workforce. Cloud products allow users to secure their systems, ensuring customer information is kept secure and that employees, contractors, and partners access the system in compliance with security protocols.

Okta describes its platform as “extensible, user-friendly, and agnostic,” and prides itself on being able to easily integrate it into customers’ existing solutions, so users can choose the best technology for their needs. The company has seen more than 7,000 integrations to its software, and claims a customer base of more than 18,000 customers.

The cybersecurity industry, where Okta resides, was valued at $202 billion last year and is projected to reach $425 billion by 2030. That makes it a huge growth industry, with a huge addressable market and plenty of room for a smart company to expand. Okta shows she’s worth the chance.

At the end of calendar year 2022, Okta has gone from recording a net loss to recording a net profit. In its most recent financial results — for the first quarter of fiscal 2024, released at the end of May — Okta showed top earnings of $518 million, which is $7.4 million more than forecasts and up 24% year-over-year. The company’s earnings, reported as an underlying income of 22 cents per share by GAAP, was 10 cents better than expected — and a solid turnaround from the 27 percent net EPS loss reported one year earlier. The strong results were supported by $503 million in subscription revenue, a forward-looking metric, which was up 26% year-over-year.

In anticipation of exponential growth, Goldman Sachs analyst Gabriela Borges gave OKTA a rare double upgrade, from sell to buy, in her latest note on the company. Pointing out several reasons why Okta is likely to see strong growth in the future, Borges writes, “We see a path to 12M outperformance driven by accelerating cRPO and ARR to 15%-20% as 1) Okta’s opposite annuals in Client IAM’s business linked to consolidating its organic and earned product portfolios (supported by bottom-up tranche model); 2) workforce segment stabilizes after transition to market changes and headwinds from macroeconomics; 3) Okta slopes in cross selling associated with new product cycles such as IGA (Identity Management and Administration) and PAM (Privileged Access Management).

Borges also explains why Okta is well positioned to sustain growth in the face of larger competitors, saying of the company, “While we believe competition from Microsoft will continue to be a drag on the stock, we reverse this in our bull case scenario by continuing to discount the Okta multiple of 30.” % approximately compared to peers. Even at this discount, our updated scenario analysis suggests a 3:1 upward/downward skew based on our estimates for fiscal year 26 (CY25).

Looking ahead, Borges completes its new Buy rating on this stock with a price target of $91 indicating potential for an upside of 27% in the one-year horizon. (To watch Borges’s record, click here)

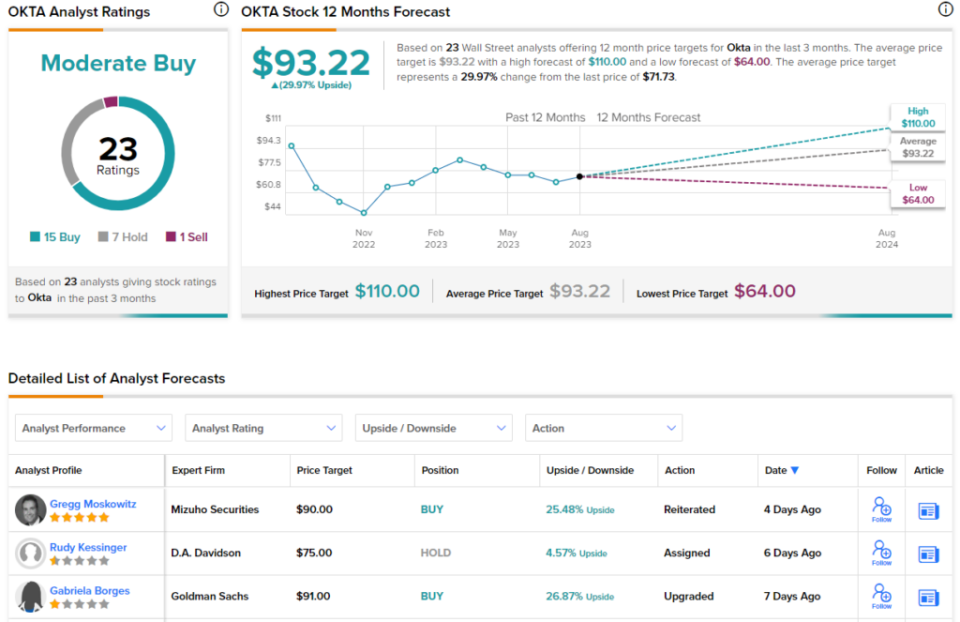

Overall, OKTA shares carry a Moderate Buy from Street consensus rating, based on 24 recent reviews that include 16 Buys, 7 Buys, and 1 Sell. An average share price target of $93.22 is a bit more bullish in Goldman’s view, and suggests an upside of 30% from the current trading price of $71.73. (be seen OKTA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best stocks to buya tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.